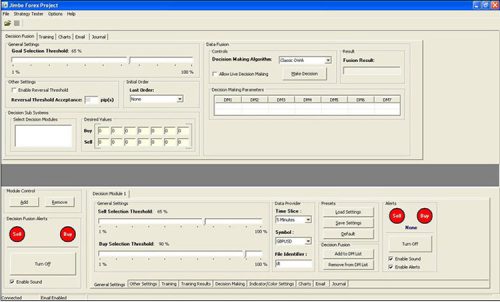

Jimbo Forex Project

Info

Artificial Intelligence Alternative Solutions Lab

2008-08-01

Creating advanced algorithms designed to generate trading signals intelligently.